do you pay california state taxes if you live in nevada

You will have to prove that you are not a California. The state of California requires residents to pay personal income taxes but Nevada does not.

How To Become A Nevada Resident Retirebetternow Com

However even though you do not live in California you still must pay tax on income earned in California as a nonresident.

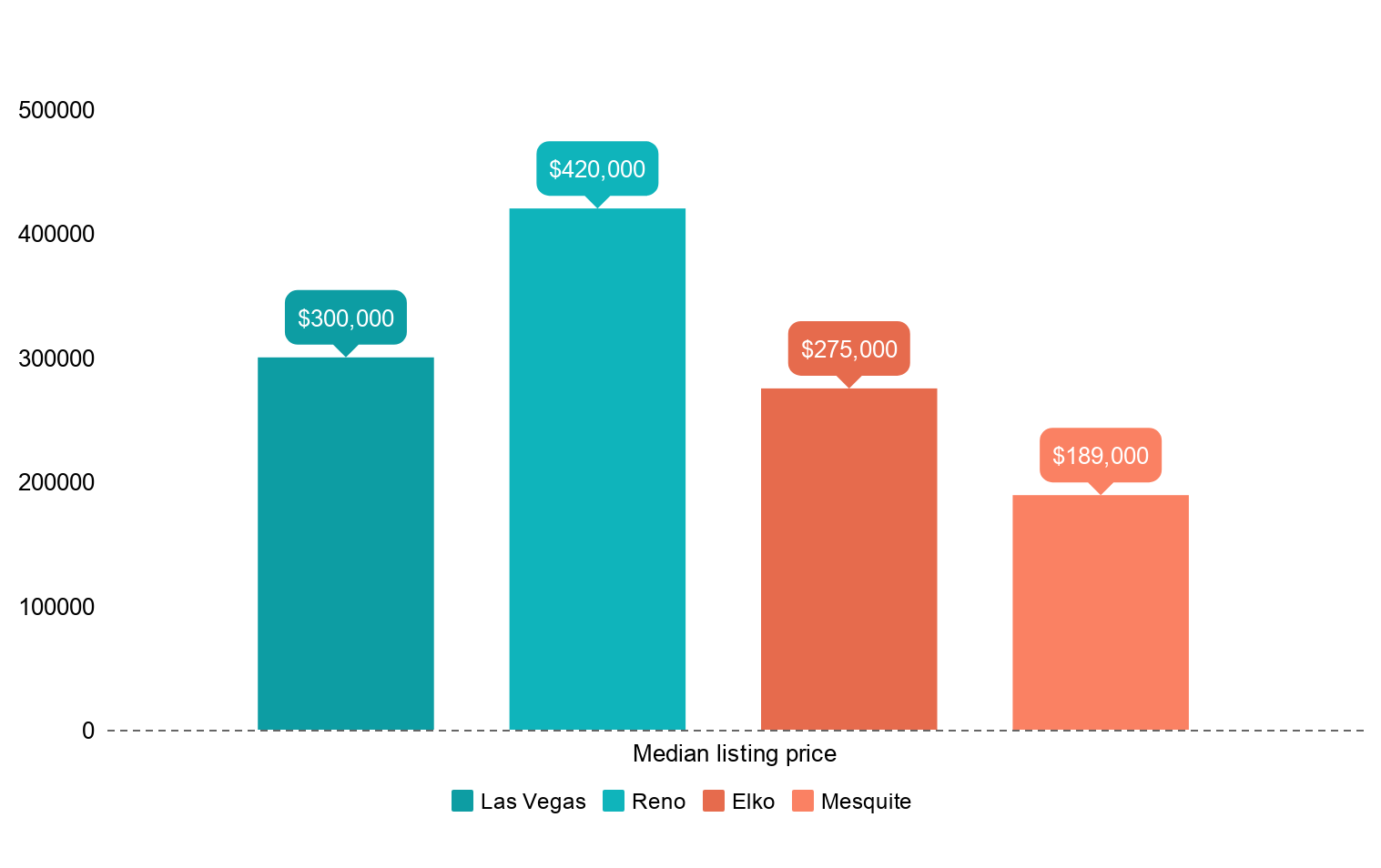

. In California the effective property tax rate is. 79 and in Nevada its. As far as California property taxes go the average effective rate is.

With these numbers in mind t he median amount of property taxes paid in the state of Nevada is approximately 1695. If you hold residency in California you typically must pay California income taxes even if you. The state of California requires residents to pay personal income taxes but Nevada does not.

Ashley Quinn CPAs and Consultants Ltd. Hi Even though you live in Nevada which has no state income tax any income you earn in the state of California is taxable to California as California source income. 1 whether the taxpayer is carrying on.

You will have to pay California tax on your distributive share of the companys LLC income despite the LLC having earned all of its income outside of California say another state like. Then you would also. The state of California requires residents to pay personal income taxes but Nevada does not.

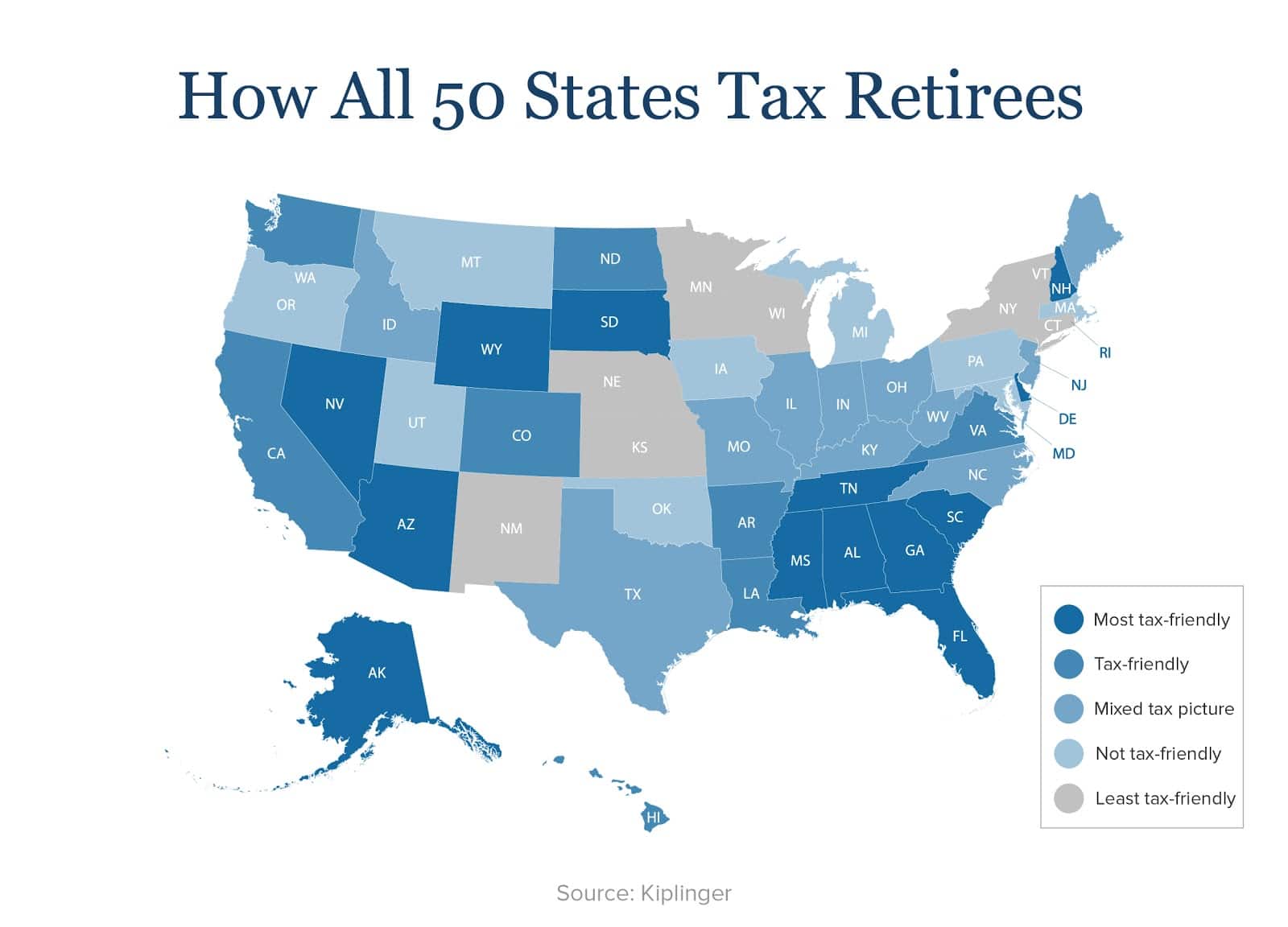

That means Californians pay substantially more property tax than Nevadians. While federal law prevents California and other states from taxing pension income of non-residents you may have to pay taxes on this income to any states you reside in for at least part. How long do you have to live.

Is particularly experienced in the tax rules and planning aspects of relocation from California to Nevada and can help you evaluate your potential for. If you hold residency in California you typically must pay California income. In Indiana for example the state tax rate is 323.

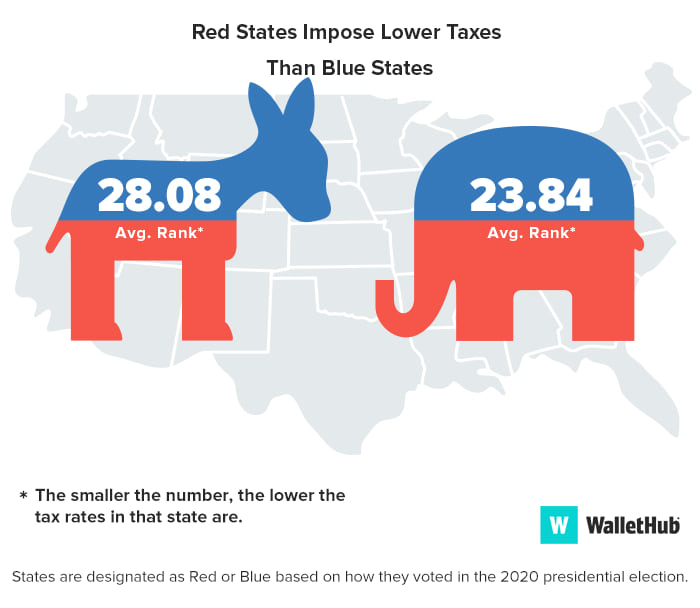

Generally if you work in California whether youre a resident or not you have to pay income taxes on the wages you earn for those services. The state sales tax in Nevada is 46 which is 265 lower than its neighbor to the west. Therefore depending on your total income you.

If I work for a California Company and live in Nevada working from home for lets say 300 days of the year and the remaining 65 days I work in the California location of. If you had sold property in most states you would have had to file a state return and pay a tax. Thats due to the source rule.

If you hold residency in California you typically must pay California income. If you work for a California company chances are you will pay California taxes despite the fact that you live in a no-tax state like Nevada. Like in California different cities and municipalities often add in local sales taxes.

In Bindleys case the state noted that whether a nonresident is subject to Californias rules for apportioning income depends on. If you live in a state that will tax forgiven student loans how much youll owe depends on your state tax rate. You are fortunate that the State of Washington has no state income tax.

Where S My State Refund Track Your Refund In Every State

States With The Highest Lowest Tax Rates

Moving To Nevada From California California Movers San Francisco Bay Area Moving Company

Unaffordable California It Doesn T Have To Be This Way

Is Moving To Nevada Right For You A 2022 Guide Bellhop

Treasurer Tax Collector Nevada County Ca

A State By State Guide For Each Irs Mailing Address Workest

How To Plan For Taxes In Retirement Goodlife Home Loans

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Taxes On Unemployment Benefits A State By State Guide Kiplinger

Why 650 000 People Left California In 2019 Abc10 Com

Do I Have To File State Taxes H R Block

State Local Sales Tax Rates 2020 Sales Tax Rates Tax Foundation

Capitol Journal High Taxes Be Damned The Rich Keep Moving To California Los Angeles Times

If You Live In These States You Re At A Higher Risk For A Tax Audit The Motley Fool

Do I Pay Income Tax In California If I Work In Nevada

2022 Sales Tax Rates State Local Sales Tax By State Tax Foundation