omaha nebraska sales tax rate 2020

For tax rates in other cities see Nebraska sales taxes by city and county. Both bills would reduce the 7 sales tax on groceries.

Sales Taxes In The United States Wikiwand

The Omaha sales tax has been changed within the last year.

. ArcGIS Web Application - Nebraska. Nebraska Department of Revenue. Published by Scott Stewart on Sun 06142020 - 901pm Gretna will see its sales tax rate increase from 15 to 2 effective Oct.

Nebraska added 135163 new residents between 2010 and 2020. Counties and cities in Nebraska are allowed to charge an additional local sales tax on top of the state sales tax. The current total local sales tax rate in Omaha NE is 7000.

The minimum combined 2022 sales tax rate for Omaha Nebraska is. The state capitol Omaha has a. Interactive Tax Map Unlimited Use.

You can print a 7 sales tax table here. The Omaha Sales Tax is collected by the merchant on all qualifying sales made within Omaha. Nebraska has state sales tax of 55 and allows local governments to collect a local option sales tax of up to 2.

The Nebraska state sales tax rate is 55 and the average NE sales tax after local surtaxes is 68. The Senate plan would by 2032 or maybe later if state tax receipts falter create a single flat state income tax of 499. There is no applicable county tax or special tax.

Local sales tax above 1½ percent8This additional local sales tax in many cities places the average combined sales tax rate in Nebraska at around 7 percent although many cities are higher. Omaha collects a 15 local sales. 2020 erasa a T aTle continued f erasa taale income is.

Nebraska City 20 75 075 16-339. The Nebraska state sales and use tax rate is 55 055. The Nebraska sales tax rate is currently.

Senate Bill 3164 would eliminate part of the income tax while House Bill 531 would phase out the income tax over several years. The Omaha sales tax rate is. Twenty-seven cities levy a 2 percent tax for a total state and local combined rate of.

Roca 10012020 15 Table 5 Local Sales Tax Rates Continued. In addition Bertrand Superior and Waverly will each increase their rates to 15 Randolph will decrease its rate to a 15 rate. The income tax proposal would lower the top individual tax rate from 684 to 584 by January 2027.

See the County Sales and Use Tax Rates section at the end of. FILE - In this April 20 2021 file photo Arizona Supreme Court. Click here to find other recent sales tax rate changes in.

Iowa Proposing Tax Reduction. Supporters of the measure note. Ad Lookup Sales Tax Rates For Free.

Stay up-to-date on the latest in local and national government and political topics with our newsletter. 1 the Village of Orchard will start a 15 local sales and use tax. A sales tax rate is calculated by comparing the state county and city rates.

He said a 4 state income tax would soon be the norm nationally. The Omaha Nebraska sales tax is 700 consisting of 550 Nebraska state sales tax and 150 Omaha local sales taxesThe local sales tax consists of a 150 city sales tax. Trev Alberts discussed working toward a negotiated resolution on the potential NCAA violations making 350000 in.

The top corporate income tax rate would drop from 75 to 584. Effective April 1 2022 the city of Arapahoe will increase its rate from 1 to 15. The 7 sales tax rate in Omaha consists of 55 Nebraska state sales tax and 15 Omaha tax.

2020 Nebraska Tax Table 3060 10060 17060. Lincoln The City of Lincoln will increase its local sales and use tax rate to 175 effective Oct according to a release from Nebraska Tax Commissioner Tony Fulton. There are a total of 295 local tax jurisdictions across the state collecting an average local tax of 055.

The December 2020 total local sales tax rate was also 7000. 800-742-7474 NE and IA. Bryan Slone president of the Nebraska Chamber of Commerce said 20 other states including Iowa are adopting similar plans to broaden the tax base and lower overall rates.

1 2020 Deshler will collect a new 1 sales and use tax while Unadilla will collect a new 15. It was lowered 05 from 825 to 775 in March 2022 raised 05 from 775 to 825 in March 2022 and lowered 05 from 825 to 775 in February 2022. There are no changes to local sales and use tax rates that are effective January 1 2022.

Jurisdiction Effective Date Rate Jurisdiction Effective Date Rate Annexed into Omaha 03012007 continued on next page Nebraska Tax Rate Chronologies Gordon 0101202115 1001198210 Gothenburg01011998 15. This is the total of state county and city sales tax rates. There are no changes to local sales and use tax rates that are effective July 1 2022.

Omaha Nebraska has a 6 sales tax on top of the personal property tax for 2021 combined. Omaha Nebraska taxes its sales tax at a rate of 55. Local Sales and Use Tax Rates Effective January 1 2020 Dakota County and Gage County each impose a tax rate of 05.

What Is Omaha Ne Sales Tax. Groceries are exempt from the Omaha and Nebraska state sales taxes. The County sales tax rate is.

1 according to the Nebraska Department of Revenue. Average Sales Tax With Local.

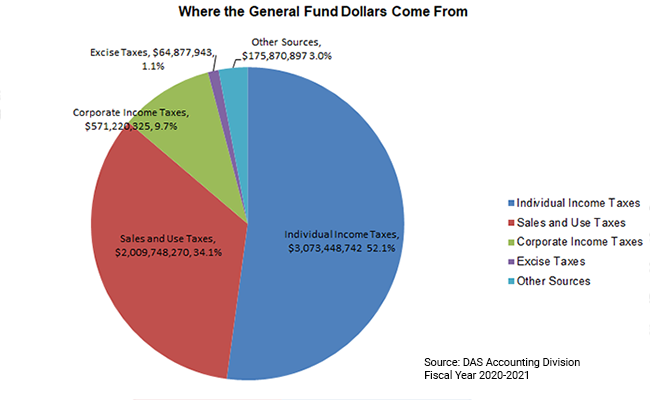

General Fund Receipts Nebraska Department Of Revenue

Sales Taxes In The United States Wikiwand

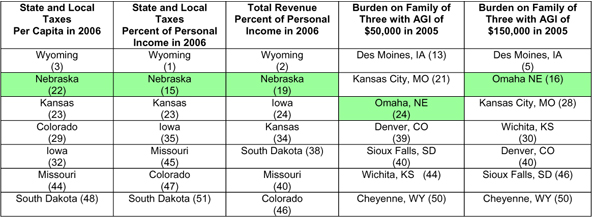

Tax Foundation Proposed Tax Rate Increases Undo Impact Of Property Tax Cuts

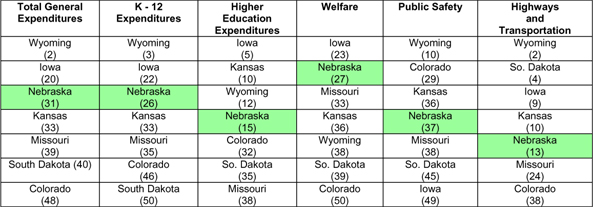

Taxes And Spending In Nebraska

Taxes And Spending In Nebraska

Sales Taxes In The United States Wikiwand

Nebraska Income Tax Brackets 2020

Which Cities And States Have The Highest Sales Tax Rates Taxjar

Sales Taxes In The United States Taxable Itemsและcollection Payment And Tax Returns

Removing Barriers In Nebraska Part Three How Our Taxes And Spending Compare

A Guide To Omaha And Nebraska Taxes

Sales Taxes In The United States Taxable Itemsและcollection Payment And Tax Returns

Sales Taxes In The United States Wikiwand

How High Are Cell Phone Taxes In Your State Tax Foundation